In light of the aforesaid position, both in law, as well as on facts, we are not persuaded to accept the case of R1. If at all R1 is of the view that he has an explanation for the voluminous data supplied by R3 to R6, forming the basis for the offending CIR, nothing prevents him from making an application online seeking alternation of the CIR. 39. This Original Side Appeal is allowed in terms of the above order. No costs. (ANITA SUMANTH, J.) (C.KUMARAPPAN, J.) 09.04.2025 vs Index: Yes Speaking order Neutral Citation: Yes To The Sub Assistant Registrar, Original Side, High Court, Madras. DR.ANITA SUMANTH, J. AND C.KUMARAPPAN, J. vs OSA.No.326 of 2019 09.04.2025 [1] 2011 SCC OnLine Cal 5473 [2] W.P. No. 6409 of 2010 dated 24.11.2010 (Bombay High Court) [3] 2018 SCC Online Hyd 274 [4] (supra foot note 2) [5] (supra foot note 3) [6] (supra foot note 2) [7] (supra foot note 1) [8] Arb.O.P.(Com.Div.)No.86 of 2022 dated 18.10.2022 (Madras High Court) [9] (supra foot note 8)

2025:MHC:949

IN THE HIGH COURT OF JUDICATURE AT MADRAS

Reserved on : 04.02.2025

Pronounced on: 09.04.2025

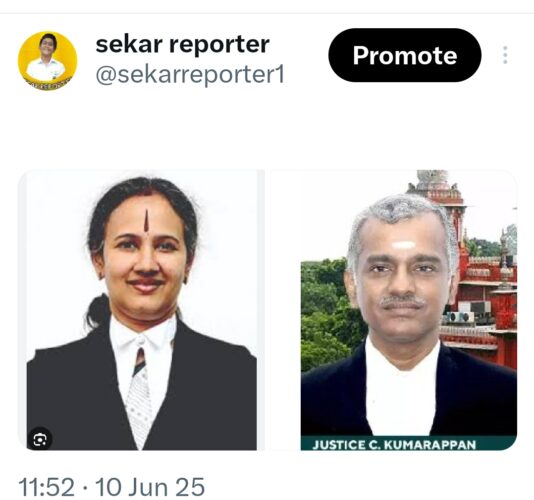

CORAM

THE HONOURABLE DR.JUSTICE ANITA SUMANTH AND

THE HONOURABLE MR.JUSTICE C.KUMARAPPAN

O.S.A.No.326 of 2019

Reserve Bank of India,

Rep. by its Regional Director

Fort Glacis, Rajaji Salai, Chennai-600 001. … Appellant

vs.

1.P.V.R.S.Mani Kumar

2.Transunion Cibil Ltd.,

Rep. by its Managing Director,

Hoechst House,

6th Floor, 193, Backbay Reclamation, Nariman Point, Mumbai-400 021.

3.M/s.Shaha Finlease Private Limited,

713, Vihan Opp. Nutan Chemical Compound, Walbhat Road, Goregaon East, Mumbai – 400 063.

4.M/s.ICICI Bank Limited,

ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, Gujarat – 390 007.

5.M/s.Muthoot Finance Limited,

Second Floor Muthoot Chambers, Opp. Saritha Theatre Complex, Ernakulam – 682 018.

6.M/s.SBI Cards and Payments Limited,

Unit 401 and 402, Fourth Floor,

Aggarwal Millenium Tower,

E1, 2, 3, Netaji Subhash Place Wazirpur,

New Delhi – 110 034. … Respondents

(R3 to R6 Suo Motu impleaded vide Court Order dated 07.01.2021 in OSA.No.326 of 2019 by this Court)

Prayer: Appeal filed under Order XXXVI Rule 1 of Original Side Rules and

Clause 15 of Letters Patent, to set aside the Judgement and Decree order dated 27/08/2019 in O.A.No.360 of 2015 on the file of this Court.

For Appellant :

Mr.Mr.C.Mohan for M/s.King And Partridge

For Respondents :

Mr.B.Mohan (for R1)

M/s.Vandana Parasuram (for R2) Mr.D.Ferdinand (for R5) for M/s.BFS Legal Mr.G.Sethuraman (for R6)

No Appearance – (for R3 & R4)

JUDGMENT

(Judgment of the Court was delivered by Dr.Anita Sumanth J.)

The Reserve Bank of India (RBI) had preferred this appeal against an order passed by the learned Judge in O.A.360 of 2015 on 27.08.2019.

2. The Original Application had been filed by R1 herein seeking an interim injunction as against TransUnion CIBIL Limited (in short ‘R2’) from continuing to publish data furnished by it in its Credit Information Report (in short ‘CIR’) dated 10.07.2014. The application has come to be allowed by way of the impugned order. The legal question that arises for determination is as to whether R1 could have invoked the arbitration clause as against R2 based on the CIR.

3. The facts in question as this Court has culled from the detailed submissions of Mr.C.Mohan learned counsel appearing for RBI, Mr.B.Mohan, learned counsel for R1, Ms.Vandana Parasuram, learned counsel for R2, BFS Legal for R5 and Mr.G.Senthilkumar, learned counsel for R3 and R6, (impleaded on 07.01.2021 in the Original Side Appeal), are set out below.

4. R1 had been operating a personal bank account with Andhra Bank

Chetput Branch, Chennai (in short ‘Andhra Bank’) and had approached that Bank seeking credit facilities. As per established procedure relating to due diligence for sanction of the loan, a CIR had been sought which reflected a negative score. Andhra Bank had thus not proceeded to process the request for

credit facility.

5. According to the credit score, R1 fell under the category of ‘high-risk’, based on two credit cards held by him, one with City Bank and other with Standard Chartered Bank. As regards the Standard Chartered credit card, there had been a dispute that had culminated in a criminal case. The matter travelled before this Court in Crl.O.P.No.7670 of 2000 and came to be settled only at that stage by R1 in full. The criminal case came to a conclusion on 08.08.2003.

6. The CIR revealed that four entities had stated that R1 owed them cumulatively, dues of Rs.1,27,14,413/-, which R1 disputed. Thus, O.A.No.360 of 2015 had come to be filed by R1 in terms of Section 9 of the Arbitration and Conciliation Act, 1996 (in short ‘A & C Act’) wherein he sought appropriate interim relief pending initiation of arbitration proceedings for settlement of the dispute. The maintainability of the application had been challenged by R2.

7. The stand of R2 was that there was an effective remedy available to R1 in terms of Section 21 of the Credit Information Companies Regulations, 2006 (in short ‘CICRA’). Hence there was no necessity for R1 to approach this Court under Section 9 of the A & C Act, and the invocation of the arbitration clause was erroneous in law. After hearing the parties in detail, the learned Judge allows the application noting the relevant provisions of the CICRA as well as the Credit Information Companies (Regulation) Act, 2005 (in short ‘CIC Act’).

8. Taking note of the decision of the learned Judge of the Calcutta High

Court in Sunil Agarwal v. LIC Housing Finance Limited and others[1], the

Bombay High Court in DSL Enterprises Private Limited and others v Chief

General Manager, DBOD, Reserve Bank of India and others[2] and the Andhra Pradesh High Court in Srikanth Vairagare v. ICICI Bank Limited and others[3], learned Judge concludes that there was no hindrance to R1 to invoke the remedy of arbitration under Section 18 of the CIRCA. Pending reference to arbitration, an injunction was granted restraining RBI and R2 from publishing the offending information.

9. Pending this OSA, R3 to R6 have been impleaded suo motu by this Court on 07.01.2021. The necessity to implead them arose from the averments in the counter filed by R2 revealing that R1 had availed credit facilities/loans from R3 to R6 in respect of which there had been defaults. Post the impleadment of R3 to R6 as proper and necessary parties for a wholistic adjudication of the matter, they have filed their counters that have been served upon R1. No reply has been filed by R1 to those counters and hence the averments contained therein are uncontroverted.

10. It is in the context of the above factual position that we proceed to answer the legal issue as to whether R1 would be entitled to invoke proceedings for arbitration under Section 18 of the CICRA. The relevant provisions of the CICRA are discussed now. The CICRA provides for the Regulation of Credit Information Companies in order to facilitate efficient distribution of credit and for matters connected therewith. Credit information is defined as follows:

‘2.Definitions.-

………

(d) “credit information” means any information relating to-

(i) the amounts and the nature of loans or advances, amounts outstanding under credit cards and other credit facilities granted or to be granted, by a credit institution to any borrower;

(ii) the nature of security taken or proposed to be taken by a credit institution from any borrower for credit facilities granted or proposed to be granted to him;

(iii) the guarantee furnished or any other non-fund based facility granted or proposed to be granted by a credit institution for any of its borrowers;

(iv) the credit worthiness of any borrower of a credit institution;

……..’

11. There is no doubt that the information contained in the CIR in question, relates to the credit worthiness of R1 and would tantamount to ‘credit information’ under the CICRA. Section 14 of the Chapter V deals with ‘Functions of a credit information company’ which states that a Credit Information Company such as R2 may engage in several businesses as

adumbrated in clauses (a) to (e). The provision reads as follows:

14. Functions of a credit information company.— (1) A credit information company may engage in any one or more of the following forms of business, namely:—

(a) to collect, process and collate information on trade, credit and financial standing of the borrowers of the credit institution which is a member of the credit information company;

(b) to provide credit information to its specified users or to the specified users of any other credit information company or to any other credit information company being its member;

(c) to provide credit scoring to its specified users or specified users of any other credit information company or to other credit information companies being its members;

(d) to undertake research project;

(e) to undertake any other form of business which the Reserve Bank may, specify by regulations as a form of business in which it is lawful for a credit information company to engage.

12. Section 18 deals with settlement of disputes and reads thus:

18. Settlement of dispute.— (1) Notwithstanding anything contained in any law for the time being in force, if any dispute arises amongst, credit information companies, credit institutions, borrowers and clients on matters relating to business of credit information and for which no remedy has been provided under this Act, such disputes shall be settled by conciliation or arbitration as provided in the Arbitration and Conciliation Act, 1996 (26 of 1996), as if the parties to the dispute have consented in writing for determination of such dispute by conciliation or arbitration and provisions of that Act shall apply accordingly.

(2) Where a dispute has been referred to arbitration under sub-section (1), the same shall be settled or decided,-

(a) by the arbitrator to be appointed by the Reserve Bank;

(b) within three months of making a reference by the parties to the dispute:

Provided that the arbitrator may, after recording the reasons therefor, extend the said period up to a maximum period of six months:

Provided further that, in an appropriate case or cases, the Reserve Bank may, if it considers necessary to do so (reasons to be recorded in writing), direct the parties to the dispute to appoint an arbitrator in accordance with the provisions of the Arbitration and Conciliation Act, 1996 (26 of 1996), for settlement of their dispute in accordance with the provisions of that Act.

(3) Save as otherwise provided under this Act, the provisions of the Arbitration and Conciliation Act, 1996 (26 of 1996) shall apply to all arbitration under this Act as if the proceedings for arbitration were referred for settlement or decision under the provisions of the Arbitration and Conciliation Act, 1996.

13. Section 18(1) provides for arbitration as a methodology for dispute resolution if there are no other methods provided under the Act for such resolution. Thus, should there be no other method provided for alteration of credit records and correction of errors, then the matter may be referred to arbitration under Section 18(2).

14. Section 21 dealing with alteration of credit information files and credit reports, and reads thus:-

21. Alteration of credit information files and credit reports.—

(1) Any person, who applies for grant or sanction of credit facility, from any credit institution, may request to such institution to furnish him a copy of the credit information obtained by such institution from the credit information company.

(2) Every credit institution shall, on receipt of request under sub-section (1), furnish to the person referred to in that sub-section a copy of the credit information subject to payment of such charges, as may be specified by regulations, by the Reserve Bank in this regard.

(3) If a credit information company or specified user or credit institution in possession or control of the credit information, has not updated the information maintained by it, a borrower or client may request all or any of them to update the information; whether by making an appropriate correction, or addition or otherwise, and on such request the credit information company or the specified user or the credit institution, as the case may be, shall take appropriate steps to update the credit information within thirty days after being requested to do so:

Provided that the credit information company and the specified user shall make the correction, deletion or addition in the credit information only after such correction, deletion or addition has been certified as correct by the concerned credit institution:

Provided further that no such correction, deletion or addition shall be made in the credit information if any dispute relating to such correction, deletion or addition is pending before any arbitrator or tribunal or court and in cases where such dispute is pending, the entries in the books of the concerned credit institution shall be taken into account for the purpose of credit information.

15. Section 21 of the CICRA provides for provision of the credit information particulars to an eligible applicant and this was duly done by Andhra Bank. The first proviso stipulates that the Credit Information Company shall make the correction, deletion or addition in the credit information only after such amendment i.e. after such correction, deletion or addition as has been certified as correct by the concerned Credit Institution.

16. Rule 21 dealing with disclosure of disputed data reads thus:

21. Disclosure of disputed data by a credit institution.- If, in the opinion of a credit institution, correction of any inaccuracy, error or discrepancy as referred to in rule 20, is likely to take further time on account of any dispute raised by a borrower in respect thereof, with the credit institution or before a Court of law, or any forum, or tribunal or any other authority, in such cases the credit institution shall adopt the following course of action, namely:-

(a) if the disputed data has not been furnished, in such event while furnishing such data to a credit information company or making disclosure thereof to anyone else, in accordance with the Act, the credit institution shall include an appropriate remark to reflect the nature of the inaccuracy, error or discrepancy found therein and the pendency of the dispute in respect thereof and in any subsequent disclosure of such disputed data the credit institution shall also disclose such remark; or

(b) in case such credit information has already been furnished to a credit information company or disclosed to anyone else, the credit institution shall inform the credit information company or the individual, as the case may be, to include the remark about such inaccuracy, error or discrepancy and the pending dispute in respect thereof, against such data, information or credit information received by them from the credit institution; and

(c) the entries in books of the concerned credit institution shall be taken into account for the purposes of credit information relating to such borrower as provided under the provisions of` second proviso to sub-section (3) of section 21 of the Act.

17. Rule 25 touches upon the accuracy of data provided by a credit information company and states that every credit information company shall adopt an appropriate procedure for verification of data information or credit information maintained by them and to ensure that the publication of the data/credit information is accurate, complete and updated.

18.Sub Rule (3) states that if some error in the data comes to its notice,

the credit information company shall send an intimation of such error/discrepancy to the specified user or the individual, and take steps to correct and forward the corrected particulars to the specified user or individual within a period of 30 days of the discovery of the error. If it is not possible, for any reason, to correct the error, the specified user or the individual shall be informed of the same. The aforesaid procedure is to be followed scrupulously, failing which the credit information company is, in terms of Sub Rule (5), to be held liable for contravention of the provisions of the Act.

19. Section 26 dealing with disclosure of the disputed data by a Credit Information Company states that if the credit information company opines that the correction of an error or discrepancy is likely to take time on account of any dispute raised by a borrower with that institution or before a Court of law, then the disclosure of the disputed data shall include an appropriate remark to reflect the nature of the inaccuracy, error or discrepancy.

20. Read in totality, the scheme of the CICRA and connected Regulations issued in exercise of the powers conferred under Section 46 of the CIRCA, reveal that the maintenance of credit information of a person is intended as a measure of protection against future borrowings by that person.

21.The Act and Rules together, provide for a self-contained scheme by which data relating to a person/specified user/entity would be available to financial institutions in public interest. What emerges is that there is also an inbuilt mechanism for dispute resolution within the scheme of the Act and Rules.

22. R2 would specifically point out that the accuracy of the data is based on the data that is applied by the financial institution, in this case, R3 to R6. Be that as it may, the sum and substance of the arguments of both the appellant (RBI) and R2, duly supported by R3 to R6, hinges upon the admitted position that recourse is available to a person under Section 21 for alteration of the credit information file or credit report.

23. Section 21(3) states that, if a borrower or client requests the company to update the credit information of the client, such updation shall be carried out by the company upon receipt of the request from the user within thirty (30) days from such request being received. There is also no dispute on the position that updation includes amendments, alterations, modifications and correction of

errors if any, in the credit report.

24. Hence, the question of taking resort to Section 18 would not arise in such circumstances where an efficacious alternate remedy exists in the Act. We agree that Section 18 would stand triggered only in a situation where no alternate remedy is provided under the CICRA and in the present circumstance Section 21(3) is well available as an alternate and efficacious remedy.

25. As to whether any request has been made by R1 in terms of Section 21(3), though R1 would maintain that such request was made under letter dated 20.08.2014, no acknowledgment is available either for dispatch or receipt of that communication by R2. There are specific denials in this regard in the affidavits filed by R3 to R6 as well as in the counter filed by R2 where R2 has suggested that the offending CIR could well have been amended by making a simple online application on the website of R2, which has not been done.

26. Since Section 21 provides for alteration of credit information file and

credit report, and offers an alternate of efficacious remedy of amendment/alteration prior to resort to arbitration, in our considered view, there is no avenue to explore recourse to arbitration, till such time the remedy under Section 21(3) is availed and exhausted, which has not been done in this case.

27. We now advert to the decisions cited by parties. The Division Bench of the Bombay High Court in the case of DSL Enterprises Private Limited[4] dealt with the case of a wilful defaulter. After noticing the relevant provisions of the CICRA and Rules, the Bench concludes as follows:

11.We have perused the reasoning set out in the impugned order as well as the scheme of the C.I.C. Act and more particularly Sections 2, 6, 14 and 18 and the finding recorded in the impugned order that there is no dispute of the matters relating to the business of credit information within the meaning of Section 18 of the Act, cannot be said to be erroneous and once this issue has been answered in the negative, there was no question of appointment of an Arbitrator. The term “business of credit information” does not confine to a limited sphere between the petitioners and the bank, and if the same is to be read in the facts of this case the information displayed on the website of CIBIL and as provided by the Bank of Maharashtra under Section 14(a)(a), naming M/s.Datar Switchgear Limited as a willful defaulter would not relate to the “business of credit information” within the meaning of the C.I.C. Act. It is mainly a dispute between the petitioners and the Bank of Maharashtra and if the petitioners are aggrieved by the said action of the bank their remedy may lie somewhere else but not an application under Section 18 of the C.I.C. Act. CIBIL cannot be dragged in the dispute as to whether the Company was wrongly named as a willful defaulter by the bank. In fact in Special Civil Suit No.679 of 2009, in addition to the reliefs for recovery of damages, the relief (xvi) as set out in the plaint reads as follows:-

“declare that the plaintiffs are not “defaulters” or “willful defaulters” of the Defendant No.2 in terms of the submissions of the Reserve Bank of India.”

28. The Bench noted that the dispute arose in relation to the business of credit information within the meaning of Section 18 of the Act. Section 18 is premised on a dispute relating to ‘matters relating to business of credit information and for which no remedy has been provided under this Act’. Since the Division Bench held that there was no matter relating to ‘business of credit information’ that arose for consideration in that case, the question of resorting to arbitration did not arise. That decision involves a different and

distinguishable set of facts inapplicable to the present case.

29. In the case of Srikatnh Vairagare[5], the Court was concerned with a credit card holder who fell within the sweep of the term ‘borrower’. Applying the ratio of the decision in DSL Enterprises Private Limited[6], the petition seeking appointment of Arbitrator under Section 11(6) of the Act came to be dismissed.

30. In Sunil Agarwal[7], too, the Calcutta High Court was concerned with a grievance that a petition filed under Section 18 of the CICRA was not taken up for adjudication. The petition was disposed directing RBI to treat the petitioner’s application as a reference under Section 18 of that Act and dispose the same. Inter alia, the Court records that it was nobody’s case that the applicant had any other remedy under the CICRA. The respondents in that case had also not taken such a defence. Hence, that case is also distinguishable on

facts.

31. A learned Judge of this Court in Kirankumar Moonchand Jain v. Transunion Cibil Ltd.[8] considered a similar issue in Arbitration O.P. (Commercial Division) No.86 of 2022. The petitioner therein had provided a personal guarantee for a loan taken by a company, and had approached the Court seeking constitution of an Arbitral Tribunal under Section 18 of the CICRA. In that case too, the defence was that the petitioner had not exhausted the alternate remedy under Section 21(3). Though the Respondents pointed out the existence of the Ombudsman, no alternate remedy was pointed out.

32. Section 21(3) of the CICRA provides for a viable method of alternate resolution where the applicant has merely has to make an online application seeking amendment of the data attained in the report and this constitutes an efficacious, alternate remedy. The remedy under Section 21(3) does not appear to have been brought to the notice of the learned Judge in the case of Kirankumar Moolchand Jain[9] and hence, and to that extent that decision does not persuade us.

33. Yet another distinction, though drawn on the facts of the present case is that the respective financial institutions i.e. Shaha Finlease Private Limited (R3), ICICI Bank (R4), Muthoot Finance Limited (R5) and SBI Cards and Payments Limited (R6) have filed affidavits pointing to the lack of credit worthiness of R1. We advert to the same in the interests of completion.

34. Under affidavit dated 22.03.2021, the City head of R3, a non-banking financial institution that has purchased the bad debt/NPA from Standard Chartered Bank states that assignment agreement dated 09.02.2010 containing various of the defaulters includes the name of R1. Those debts relate to credit card A/c Nos.5407111100071987 & 4129058681187775.

35. It is relevant to note that the aforesaid two cards are different from the Standard Chartered Credit Card that has been referred to by R1 in the application. The Credit Card referred to by R1 in O.A.No.360 of 2016 is 5473 5931 0412 2008. The two credit cards referred to by R3 in its affidavit have not been disclosed by R1 in the affidavit filed in support of O.A.No.360 of 2016.Under affidavit filed on 23.02.2021, R4 refers to a credit card bearing account No.377041110391777. Under affidavit dated 17.03.2021, R5, Muthoot Finance Limited states that R1 had availed several gold loans. On 07.06.2017, a loan of Rs.5,50,000/-had been availed vide loan No.1842SML00000289 by pledging gold. R1 had defaulted and ultimately closed the loan under one-timesettlement process on 08.06.2018.

36. A second gold loan had been availed on 25.04.2017 for a sum of Rs.5,17,900/- under loan account No.1842MPL00000021 by pledging gold.

Here too there was a default, and ultimately the loan account was declared as NPA and the gold pledged by R1 had been sold to recover the dues. After setting-off the amount recovered in auction, there is still an outstanding of

Rs.5,681/- as of 03.09.2018, with accrued interest.

37. Vide affidavit dated 17.03.2021, SBI Cards and Payments, R6, has stated that credit card facility had been availed under Account No.0004006661011010191 and a sum of Rs.1,78,631.64 is outstanding. The last payment made by R1 on that score was on 20.09.2004 and no further payments have been made. In that affidavit, the authorized signatory of R6 had stated that despite their best effort the whereabouts of R1 could not be traced. The contents of the aforesaid four affidavits stand uncontroverted.

38. In light of the aforesaid position, both in law, as well as on facts, we

are not persuaded to accept the case of R1. If at all R1 is of the view that he has an explanation for the voluminous data supplied by R3 to R6, forming the basis for the offending CIR, nothing prevents him from making an application online seeking alternation of the CIR.

39. This Original Side Appeal is allowed in terms of the above order. No costs.

(ANITA SUMANTH, J.) (C.KUMARAPPAN, J.)

09.04.2025

vs Index: Yes

Speaking order

Neutral Citation: Yes

To

The Sub Assistant Registrar, Original Side,

High Court, Madras.

DR.ANITA SUMANTH, J.

AND C.KUMARAPPAN, J.

vs OSA.No.326 of 2019

09.04.2025

[1] 2011 SCC OnLine Cal 5473

[2] W.P. No. 6409 of 2010 dated 24.11.2010 (Bombay High Court)

[3] 2018 SCC Online Hyd 274

[4] (supra foot note 2)

[5] (supra foot note 3)

[6] (supra foot note 2)

[7] (supra foot note 1)

[8] Arb.O.P.(Com.Div.)No.86 of 2022 dated 18.10.2022 (Madras High Court)

[9] (supra foot note 8)